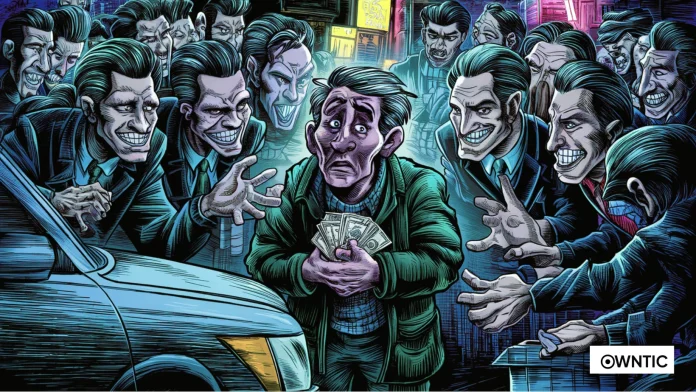

Car loan modification and refinancing scams are on the rise, promising to reduce your auto loan payments for a fee. However, these scams can leave you in financial trouble and even result in the repossession of your vehicle. Here’s what you need to know to protect yourself:

Car Loan Modification Scams:

Scammers promise to negotiate lower rates on your behalf but often request upfront payments or unusual forms of payment, such as money transfers or gift cards.

They may pressure you to sign a contract without verifying your credit score or checking your eligibility for loan modification.

If you fall for the scam, the scammer may ask you to make payments directly to them instead of your lender, leading to missed payments and potential repossession.

Auto Loan Refinancing Scams:

Scammers claim they can lower your monthly payments but demand upfront fees before providing any services.

They may instruct you to stop making payments to your lender and instead pay them directly. However, they won’t negotiate with your lender, and your payments may disappear into the scammer’s pockets.

Be cautious of promises like special relationships with lenders, guaranteed lower payments, and money-back guarantees – they’re all red flags of a scam.

What to Do If You Can’t Afford Your Payments:

Contact your lender immediately and discuss your options, such as auto loan modification or returning the vehicle.

Don’t ignore the problem, as delaying could lead to additional fees, damage to your credit, and repossession.

Understand your rights regarding repossession and deficiency balances in your state, and seek legal advice if necessary.

Avoiding Scams:

Research refinancing companies online and check for reviews or complaints.

Take your time to understand the terms before signing any agreement.

Seek advice from trusted individuals before committing to any refinancing offer.

Be wary of companies promising guaranteed payment reductions – such claims are often signs of a scam.

By staying informed and vigilant, you can protect yourself from falling victim to car loan modification and refinancing scams. Always verify the legitimacy of any offers and never hesitate to seek assistance if you suspect fraudulent activity.

Thanks for reading